Sectors

If you are a family business, farmer, GP or buy-to-let landlord looking for specialist accountancy advice, then you are in the right place.

Clayton & Brewill’s chartered accountants are generalists in the very best sense of the word.

No matter the sector you work in, we can help you with the full range of your business accountancy and advisory queries, from bookkeeping to management accounts, from payroll to succession planning.

Over the past 60 years, we have also developed specialist expertise and a strong client base in a number of key sectors.

Our specialist sectors include:

Find out more

For a friendly and confidential conversation about any aspect of your accountancy needs please drop us an email or call us on:

0115 950 3044

We’d be pleased to help you.

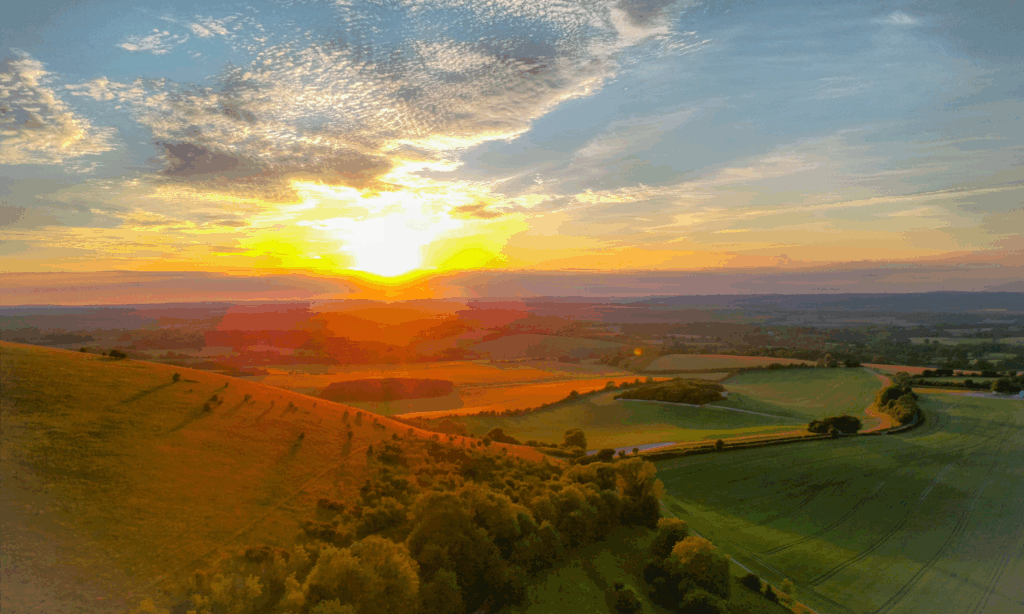

Farmers and rural businesses

Since 1946 Clayton & Brewill has been quietly supporting the rural community, providing specialist accountancy services to farmers and rural businesses across Leicestershire, Nottinghamshire and the wider East Midlands. We are proud to include a number of award-winning farms and food producers amongst our diverse client base.

GPs, locums and medical practices

We know from our GP and doctor clients that they are facing challenging times, with incomes being squeezed and increased reporting and regulatory burdens. Clayton & Brewill can guide you through these challenges, helping you to maintain compliance, maximise your earnings and minimise your current and future tax burden.

Family

businesses

At Clayton & Brewill we understand family businesses, and a large proportion of our clients are family-owned and run. We work closely with many family businesses, of all shapes and sizes, from start-ups to those in their fifth and six generation. Our clients trust us to help them identify the best route for both the business and the family.

Buy-to-let landlords

From ‘accidental’ landlords with a single property through to those with large property portfolios, we work with our landlord clients to provide proactive and cost-effective accountancy support and tax advice.

Latest Insights

Financial updates and general news from Clayton & Brewill

How will the 2026 IHT changes impact business owners?

The Autumn Budget 2024 saw some significant changes being made that will likely impact many business owners when they come into force in 2026. With

10 takeaways from the Autumn Budget 2025

Chancellor Rachel Reeves delivered the Autumn Budget 2025 amid controversy after an early OBR leak. From capital allowances to NI threshold freezes, Nottingham chartered accountants

“No need to file a tax return” is not the same as “no tax bill”

Earlier this year the government announced that up to 300,000 people would no longer need to file a tax return, a particularly welcome piece of

Compulsory purchase orders: potential issues for rural landowners

Compulsory purchase orders (CPOs) are an increasingly important topic for landowners and those who receive compensation need to be aware of the potential tax issues